Service, Quality is Our Top Priority

0

Manufacturing Cooling Products

0%

Full Inspection to Ensure Quality

0

More than 1000 Fan Specifications

Popular Products and Services

Customized cooling service to create a unique solution, EVERCOOL provides professional advice and design to ensure the best cooling effect.

EVERCOOL has more than 30 years of experience in R&D and manufacturing of various fans and heat sinks, providing customers with a full range of cooling solutions and professional consulting services.

High-Quality Products

More than 30 years of experience in the development and production of heat dissipation related products, and develops various types of products to meet market demand.

USB Portable Fan Series

IntroductionLaunches USB fan series, a variety of specifications are available. The fan is powered by the USB interface.

High Performance Thermal Paste

IntroductionHigh-performance thermal interface material has high-efficiency thermal conductivity and strong stability.

Various Computer Accessories

IntroductionVarious accessories make computer installation easier, including various cables, filters, hard drive conversion brackets, etc.

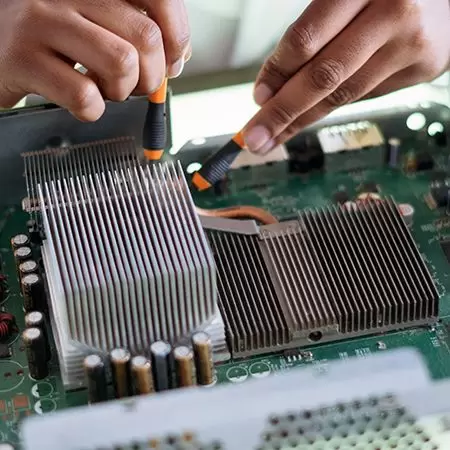

Customized Various Types of Heat Sinks

IntroductionWe have technical equipment and can provide customized services to ensure that the heat sink meets your requirements.